-40%

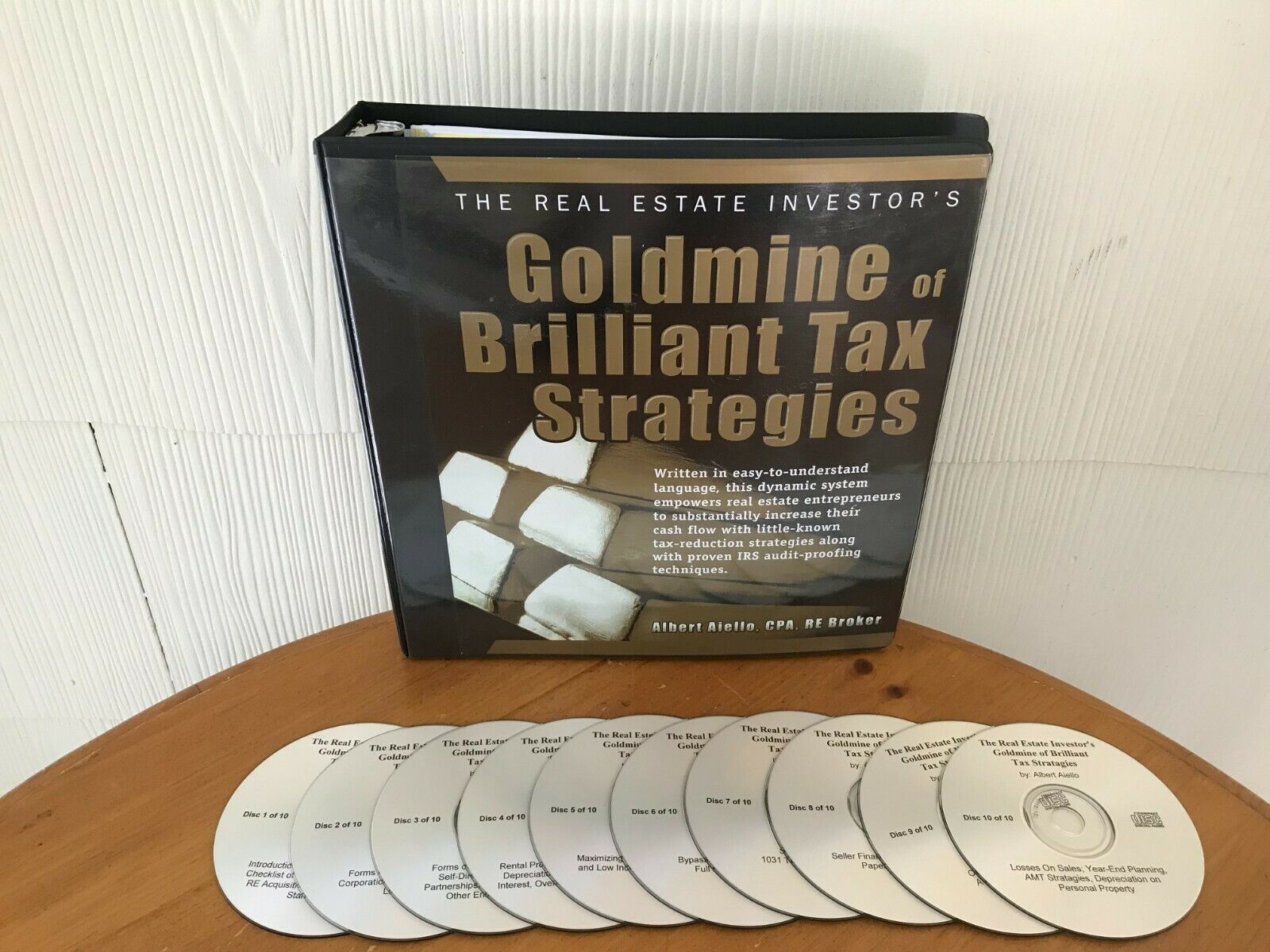

GOLDMINE OF BRILLIANT TAX STRATEGIES BY ALBERT AIELLO - MANUAL & 11 CD'S! RARE!

$ 155.76

- Description

- Size Guide

Description

REAL ESTATE TAX SECRETS!The Real Estate Investor's Goldmine of Brilliant Tax Strategies

By Albert Aiello CPA,

RE Investor

Contains OVER

750 Tax Saving Ideas For All Kinds of Real Estate Investing!

Updated CD Series!

Save ,000’s Of Dollars In Taxes Every Year Without IRS Problems and Without Having To Pay High-Priced Tax Advisors!

Total Package Includes:

Large Course Manual

10 Total Audio CD's

One Forms Disc

The Real Estate Investor's Goldmine of Brilliant Tax Strategies

By Albert Aiello CPA, RE Investor

Package includes: 350 Page Course Manual, 10 Audio CD's & One Forms CD.

Condition: Lightly Used

Welcome To Al Aiello’s Powerful Tax-Reduction Program...

The Real Estate Entrepreneur’s Goldmine Package Of Tax Reduction Strategies

_______________________________________________________________________

Save

,000’s Of Dollars In Taxes Every Year

Without IRS Problems and Without Having To Pay High-Priced Tax Advisors.

Included with Al’s home-study course are the following:

1. The Real Estate Investor’s Goldmine of Brilliant Tax Strategies

-

This updated Multi-Reference Manual of 250+ pages includes the most exhaustive research covering dynamic tax strategies for all types of real estate investments; written in plain language.

2. The Goldmine 10 Audio CD’s -

You get 15 hours of instruction on 10 audio CD’s.

You get hundreds of strategies in easy to understand ways. CD’s also make references to the specific chapters in the

Goldmine

manual making it easy for you.

3. The Goldmine Computer Software CD-ROM

-

Includes

23 Tax Reduction & IRS Audit-Proofing Forms

. These forms are specially designed so you can implement and fully document your

Goldmine

tax-reduction strategies.

Forms To Substantially Maximize Depreciation Deductions:

Double and triple your depreciation deductions

with detailed forms that include over 70 documented personal property items that can be depreciated over 5 years, accelerated, rather than 27-1/2 or 39 years, straight-line. 20 more items than can be depreciated over 15 years, using accelerated methods. Other special forms will enable you to fully write-off the building much faster than 27-1/2 or 39 years.

Includes a case study with filled-in forms and instructions.

Forms To Maximize Tax Savings -

-

Repairs Vs. Improvements:

Put huge savings in your pocket by legally writing-off large capital improvements as fully deductible repairs

with special forms that include

over 70 documented deductible repairs

, with

tax law citations for

each

item

. Includes

another case study with filled-in forms and

instructions.

Forms To Bypass Passive Loss Limits On Rental Losses:

Documents over 90 activities to prove your business & management activities so you are no longer subject to passive loss limits and will

be able to deduct any amount of rental losses (

over ,000

), no matter how large, regardless of the size of your income (

evenover 0,000 AGI

)

.

Forms To Reduce Or Eliminate Taxes On Property Sales:

Pay little or no taxes when you sell

your property

, even if profits are huge.

Forms To Reduce Or Eliminate Your Chances Of An IRS Audit:

A prime rule of tax planning is

not to get audited in the first place

. These special forms will

keep you out of the audit pile

and

save you the time, expense and aggravation of an IRS audit

.

The CD-ROM also includes:

10

Special Bonus Publications:

1.

The 0,000/0,000 Exclusions of Profits On The Sale of Your Home

2.

How Investors Can Use The 250,000/0,000 Exclusions - 12 Creative Strategies

3.

Tax-Reduction Strategies For “Rehabbers”

--

Still get depreciation on vacant properties

4.

How To Deduct A Cruise-Convention

--

Includes Overlooked Deductions

5.

7

Vital Tax Tips For The Beginning RE Investor

-

“The beginning is the most important part”

6.

Creating Tax-Free Wealth With Self-Directed IRA’S --

Updated pub. on tax-free transactions

7.

Tax Reduction Strategies Pertaining To Foreclosure Transactions

--

More savings!

8.

Refueling The “Burnt-Out” Tax Shelter

--

Regenerate tax savings on properties owned a long time

9.

Show Tax Losses On Your 1040, Yet Show Lenders You Are Making Money!

10.

How To Use The Goldmine With A Tax Advisor

–

Save big on tax advisor fees.

The CD-ROM also includes:

Additional Valuable Information (Appendixes):

_Personal Property Vs. Real Property - Legislative History, Tax Law Support, Planning Strategies

_Repairs Vs. Improvements - Interaction With Other Areas Of Tax Law, Tax Planning Strategies

_Passive Loss Limits (PAL) - Other Issues, More Strategies

_Investor Vs. Dealer - A Further Analysis With More Tax Planning Strategies

_How To Avoid Depreciation Recapture

_Alternative Minimum Tax (AMT) - Tax Planning Strategies

_Limitations With Non-Recourse Seller Financing (IRC 465), Planning Strategies

_Year-End Tax Planning Strategies For Real Estate Entrepreneurs

_Computation Of Realized gain, With Gain-Computation Forms

_Installment Sale (Seller Financing) - Other Issues More Planning Strategies

_Installment Sale Computation Form

The Goldmine 26 Tax-Reduction Reminder Checklists

(On DISK) -

With these 26 powerful tools, you will be able to take

full

advantage of

every

Goldmine tax reduction strategy and be certain that

you do

not

miss even one tax saving idea!

They reference into the Goldmine manual. When you (or your tax advisor) use these checklists, you will save thousands!!

The Goldmine Manual and Audio CD’s Include These Powerful Strategies:

*

How to save big money

every year

by creating

Astronomical

NON-CASH depreciation deductions with over 39 strategies using Al’s component method.

*

Save

more money every year

with 15 strategies to convert capital improvements into fully deductible repairs

*

How to use the component method to create

HUGE deductions (and savings)

when you “gut-out” property components with our specially designed forms

*

How to create

BIG Overlooked Deductions (and even more savings)

with Section 179 first-year expensing

*

Fully deduct, all in one year, rental property losses against ALL of your other income,

without limit

even if your income is over 0,000

*

15 ways on

how to sell\flip your property,

tax-free

. Reinvest the FULL equity for GREATER WEALTH!

*

How

not to lose interest deductions

on your properties. Avoid this tax trap!

*

How to get

Dollar-for-Dollar tax credits for your properties

*

Extensively covers “Entity Structuring”

. Using the wrong entity (or entities) can cost you big time! With the

Goldmine

you will do it right, save thousands!!

*

How to correctly use the powerful 1031 tax-free exchange to

ZERO out ALL taxes on the sales or flips of your properties.

*

26 tax strategies for seller financing; 12 strategies for buying & selling “paper”

*

Options & lease-options. The

Goldmine

extensively covers their tax dynamics with

25 creative planning strategies that will save you thousands!

*

Like NO other resource, GM extensively covers avoiding the costly consequences of being classified as a “Dealer” with over 30 proven strategies.

This alone can cut your taxes by 50%

!

*

So extensive is the

Goldmine

that it tells you how, when & why you should not waste valuable deductions so you “bank” your deductions for future years, instead of wasting them forever!

*

How to

recover taxes you paid in the past, without IRS red flags!

*

For all Goldmine tax strategies there are related IRS audit-proofing techniques with complete tax law citations and legislative histories to

use the tax law to make you wealthy, yet keep the IRS out of your life!

“I would have saved ,000 just on one transaction if I knew Al’s stuff before. He completely blew my mind with his cutting-edge tax strategies. Great to have his program!” ...

Robert Shemin, Esq. A highly successful investor and acclaimed author

“The Goldmine is the most comprehensive well put together real estate course I have seen. It has saved me over 00.00 this tax year already. I'd say that's a good return on my money. Better then even my best real estate deals. You really break it down so the average guy can understand and sort it out. Al, I can't thank you enough”

…John Zangari, Investor, Coral Springs, FL

_____________________________________________________________________________________________________

More Goldmine Bonuses

:

The Goldmine 400+ Tax Deductions For RE Entrepreneurs

Asset Protection – How To Use Only Two LLC’S To Protect Any Number Of Properties

(Includes other powerful asset protection strategies)

How Property Owners In Foreclosure\Short-Sale Can Avoid Paying Taxes On 1099\Foregiveness Of Debt –

(

Also on audio CD

; Includes Avoidance Strategies For Both Home Owners In Foreclosure And Investment Property Owners In Foreclosure, With Full Tax Law Support)

How To Fully Deduct Rental Property Deductions Even If You Are Not Personally Liable On Low Money- Down Mortgages (Including Subject-To’s), Or Even If You Do Not Have Legal Title –

(

Also on audio CD

; Includes Dynamic Planning Strategies For Creative Financing With Complete Tax Law Support And Legal Support )

Private Annuity Trust -

Avoid capital-gains, estate taxes & probate; attain asset protection

(

Also on audio CD)

Your Tax-Deductible Investment For Entire Program...91.00

Special For Limited Time Only 5

My items I sell are either brand new, My personal items, acquired at Estate sales or from previous owners contacting me to sell their items.

This is a Real Estate course and/or other media items. For this reason please understand there are No Refunds. If You are not sure what you are buying please don't buy it. Thank you for understanding.

Picture is of actual items.

Check out all of my Motivational & Success DVD and CD collections!

My entire store is on sale!! New stuff added daily!

For International see shipping above.

If you should have any questions please ask me.

PAYMENT:

PAYPAL ONLY

. PAYMENT IS EXPECTED WITHIN TWO DAYS OF THE END OF AUCTION. AT THIS TIME , THE ITEM WILL BE RELISTED, IF PAYMENT HAS NOT BEEN RECEIVED.

BUY IT NOW:

IMMEDIATE PAYMENT IS REQUIRED WITH ALL ITEMS BOUGHT WITH THE

" BUY IT NOW "

OPTION.

SHIPPING:

I SHIP MY ITEMS THROUGH USPS . WHEN USING USPS ITEMS WILL BE SHIPPED EITHER MEDIA MAIL, FIRST CLASS MAIL OR PRIORITY MAIL UNLESS SPECIFIED OTHERWISE . ALL SHIPPING FEES INCLUDE AT NO EXTRA CHARGE DELIVERY CONFIRMATIONS.

SHIPPING

IS FOR THE

LOWER 48 STATES ONLY

.

ALASKA

AND

HAWAII

& ANYWHERE IN CANADA PLEASE CONTACT ME FOR SHIPPING COST BEFORE BIDDING.

COMBINED SHIPPING:

I DO COMBINE SHIPPING ON MULTIPLE ITEMS WON AT YOUR REQUEST. IF YOU WANT SHIPPING COMBINED PLEASE CONTACT ME AND I WILL PROVIDE YOU WITH THE SHIPPING COST . THERE ARE RARE CASES WHEN COMBINED SHIPPING WILL NOT BE POSSIBLE.

SHIPPING TIME:

THE SOONER YOU PAY FOR YOUR ITEM , THE SOONER YOU WILL RECEIVE IT .

I GUARANTEE YOUR ITEM WILL BE SHIPPED WITHIN 24 HOURS AFTER I RECEIVE PAYMENT. ( EXCEPT FOR E-CHECKS , WITH AN E-CHECK I HAVE TO WAIT TILL YOUR PAYMENT CLEARS)

REFUNDS OR EXCHANGES:

I STRIVE FOR 100 % CUSTOMER SATISFACTION! A LOT OF MY PRODUCTS ARE VINTAGE & HARD TO FIND COLLECTIONS AND BRAND NEW OR USED MEDIA PRODUCTS LIKE AUDIO (CASSETTES , CD's OR DVD's) SO WE CANNOT OFFER REFUNDS OR EXCHANGES FOR THAT REASON. THANK YOU FOR UNDERSTANDING. PLEASE CONTACT ME WITH ANY PROBLEMS.